Guaranteed Rent Schemes vs. Rent Guarantee Insurance: What’s the Difference?

If you’re a landlord, you know that renting out your property comes with both rewards and risks. One of the biggest worries is whether you’ll receive your rent on time, or at all. Over the years, two popular solutions have emerged to help landlords manage this risk: guaranteed rent schemes and rent guarantee insurance.

Although these terms sound similar, they are actually quite different in how they work and what they offer. In this blog, we’ll break down both options in simple, clear language so you can decide which is right for you.

What Are Guaranteed Rent Schemes?

Guaranteed rent schemes are arrangements where a third party—usually a letting agent, property management company, or sometimes a local council—agrees to pay you a fixed monthly rent for your property, regardless of whether the property is occupied or the tenant is paying rent. In essence, you hand over the management of your property to the scheme provider, and in return, you get a steady, predictable income.

How do guaranteed rent schemes work?

- You sign a contract with the scheme provider, often for a period of one to five years.

- The provider takes on the responsibility of finding tenants, collecting rent, and handling day-to-day management.

- You receive a set amount of rent every month, even if the property is empty or the tenant defaults.

- The provider usually pays you slightly less than the full market rent, keeping the difference as their fee.

Who offers guaranteed rent schemes?

These schemes are popular in cities like London, where demand for rental property is high and void periods can be costly1. Local councils sometimes use guaranteed rent schemes to secure housing for people in need, while private companies offer them as a service to landlords who want peace of mind.

What Is Rent Guarantee Insurance?

Rent guarantee insurance is a type of insurance policy that protects landlords against loss of rental income if a tenant fails to pay their rent. It’s similar to other kinds of insurance: you pay a premium, and if your tenant defaults, you can make a claim to recover the lost rent.

How does rent guarantee insurance work?

- You purchase a policy from an insurance provider, usually on an annual basis.

- If your tenant stops paying rent, you submit a claim after a waiting period (often one month).

- The insurer pays you the unpaid rent (up to a set limit) for a specified period, typically up to 12 months.

- Many policies also include legal expenses, helping with the cost of evicting non-paying tenants.

Who should consider rent guarantee insurance?

This option is best for landlords who want to manage their own property but want a safety net in case things go wrong. It’s especially useful if you have a mortgage or rely on rental income to cover your bills.

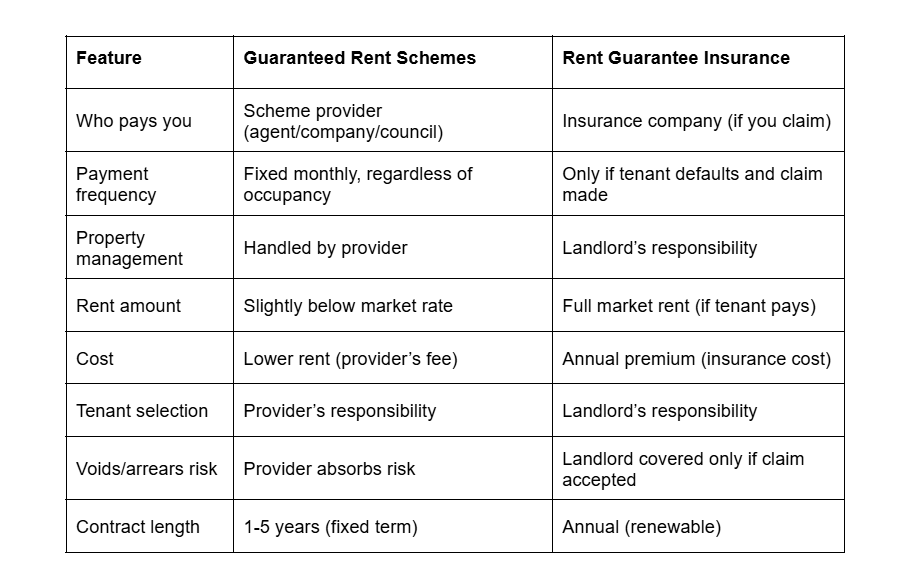

Key Differences Between Guaranteed Rent Schemes and Rent Guarantee Insurance

To make things clearer, let’s compare the two side by side:

Pros and Cons of Guaranteed Rent Schemes

Pros:

- Peace of mind: You get paid every month, no matter what.

- No voids: Even if your property is empty, you still receive rent.

- Hands-off management: The provider handles everything, from finding tenants to maintenance.

- Ideal for busy landlords: If you don’t want day-to-day involvement, this is a great option.

Cons:

- Lower income: You’ll usually get less than the full market rent.

- Less control: You don’t choose the tenants or handle the property directly.

- Long contracts: You may be locked in for several years.

Pros and Cons of Rent Guarantee Insurance

Pros:

- Full market rent: You keep all the rent your tenant pays.

- Control: You choose your tenants and manage your property.

- Flexible: Policies are usually annual, so you’re not tied in for years.

- Legal cover: Many policies help with eviction costs.

Cons:

- Claims process: You only get paid if your claim is approved, and there may be delays.

- Exclusions: Not all situations are covered; for example, some policies won’t pay out if you haven’t followed proper referencing procedures.

- You manage everything: All the work of being a landlord is still yours.

Pros and Cons of Rent Guarantee Insurance

The choice between guaranteed rent schemes and rent guarantee insurance depends on your priorities as a landlord.

- Choose guaranteed rent schemes if:

You value stability, want to avoid hassle, and are happy to accept a slightly lower income for peace of mind. This is especially appealing if you own property in busy cities like London, where voids can be expensive and time-consuming to fill1.

Choose rent guarantee insurance if:

You want to maximize your rental income, prefer to manage your property yourself, and are confident in your tenant selection process. This option gives you more control but requires more involvement.

Final Thoughts

Both guaranteed rent schemes and rent guarantee insurance are designed to help landlords protect their rental income, but they do so in very different ways. Guaranteed rent schemes offer a hands-off, predictable approach, with the trade-off of lower income and less control. Rent guarantee insurance keeps you in the driver’s seat, but you’ll need to be proactive and ready to handle any issues that arise.

Before making a decision, think about your goals as a landlord, your appetite for risk, and how much time you want to spend managing your property. Whichever option you choose, understanding the difference between these two solutions will help you make the best choice for your rental business.

If you’re considering guaranteed rent schemes in London or elsewhere, do your research, read the fine print, and make sure you’re working with a reputable provider1. And if you’re leaning towards rent guarantee insurance, compare policies carefully and make sure you understand what’s covered.